Good credit: A must for your purchase

Buying a house or condo is an important financial decision for you; on the other hand, it also involves a significant amount of money for the lender, who can’t take this request lightly. Your credit rating is therefore one of the first criteria to determine whether or not your loan is approved, and will influence the terms and conditions of your mortgage.

How essential is a credit rating to the purchase? What would be the consequences of having a poor credit record? Vistoo tells you more about the impact of your credit record and the solutions available to you.

The impact of good credit

To buy a condo or a house, you first have to go through the mortgage financing stage. What’s the difference between a borrower with good credit and one with poor credit?

Getting your application approved

For one thing, it affects how easy it is to get a loan. As we mentioned earlier, credit is a key indicator for lenders, who need to assess the risk level involved when granting you the loan. The higher your credit rating, the more likely they are to approve your application. Conversely, a low credit rating could result in you being turned down a few times if lenders feel you can’t handle this financial burden.

In fact, this could be critical for your promise to purchase. In your promise to purchase, you must undertake to prove that your loan application has been approved by a lender for the amount requested. If the deadline passes without a lender’s commitment to finance, your offer to purchase may well be cancelled.

Take advantage of better rates

That being said, the rating has a major impact on the loan terms you obtain. Even though it is possible to obtain a loan with a lower credit rating, buyers with a good score are offered the most advantageous interest rates and the most flexible conditions.

When you consider that a one-percent reduction in interest rates can translate into a few thousand dollars a year, the benefits of a good credit record are obvious: you’ll enjoy substantial savings over time.

Access to insured mortgages

The government offers insured mortgage solutions to certain buyers who have a good credit score, but are unable to provide a 20% down payment. The Canada Mortgage and Housing Corporation (CMHC), for example, offers those with a minimum score of 680 the opportunity to obtain a loan with a 5% down payment. Learn more here about down payments for condos.

However, keep in mind that this type of option comes with additional costs such as mortgage insurance premiums. The best combo for saving on fees is a good credit score and a 20% down payment.

What is a “good” credit score?

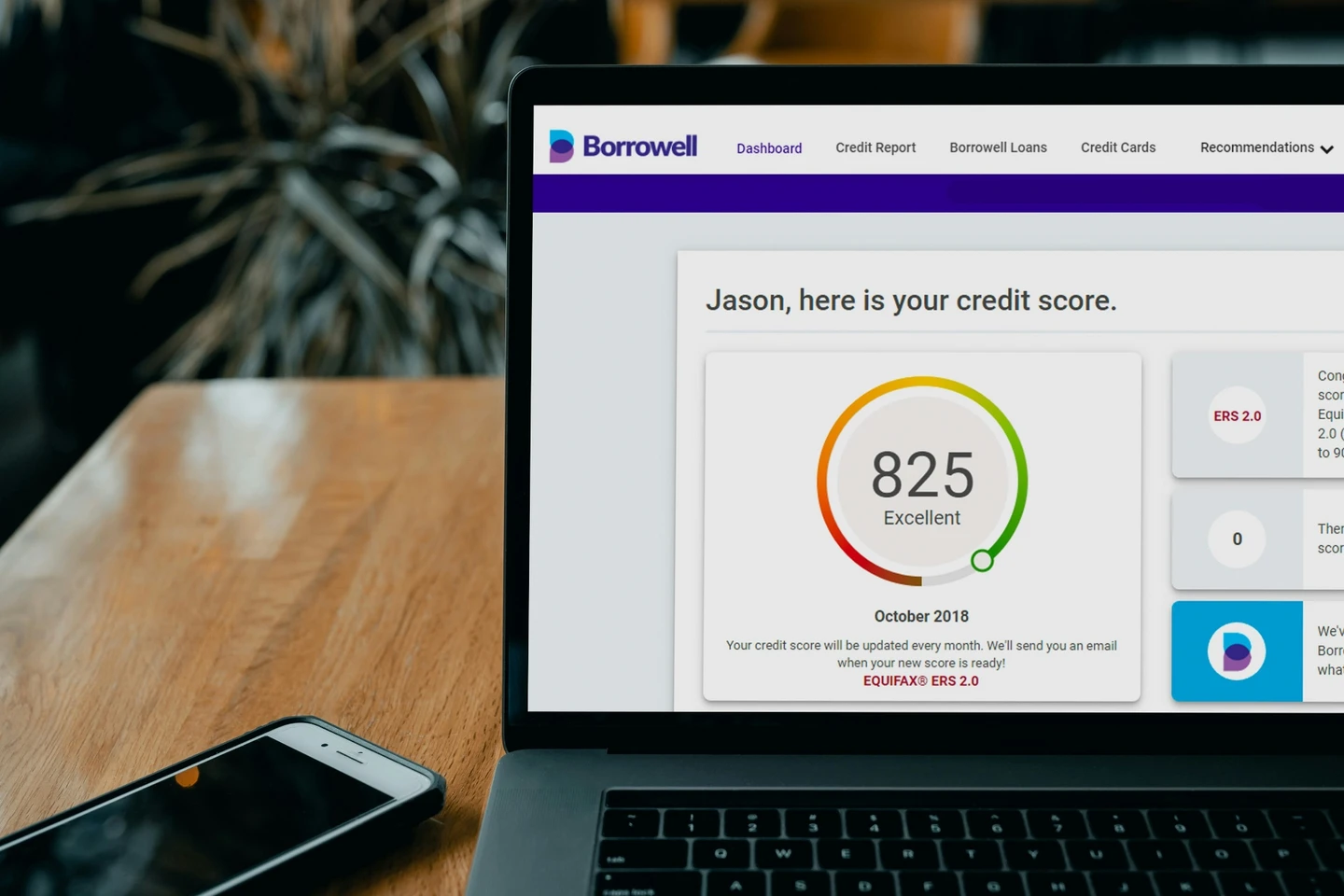

You often hear about the importance of having a “good” credit score, but what is a good score, especially when it comes to real estate?

In an Equifax credit report, a score between 660 and 724 is considered good, while a very good score ranges between 725 and 759. Scores above this range are considered excellent. As a general rule, a credit score of 680 or more is considered good when you’re looking for a mortgage.

If you’re between 600 and 679, you may be able to get a conventional mortgage, but it could be a little more difficult, especially below 620. Below 600, you’ll need to deal with a specialist lender.

“The credit score allows lenders to understand at a glance your ability to repay a mortgage based on your payment history and financial habits. That’s why it’s so important to limit the use of your credit to around 30% of the allowable limit, in addition to making your payments on time.” Gabriel Camiré, Mortgage Broker

Nevertheless, the notion of a good credit score can vary from one lender to another. And don’t forget that the rating is not the only criterion to consider. The lender will also take into account:

- Your income

- Your work history

- Your debt-to-income ratio

- The amortization period

In all cases, a high credit score will work in your favor, but it’s important to maintain it throughout the entire process, from loan approval to moving into your new home.

“The process […] often takes between six weeks and three months, but it can certainly take longer. During this time, it’s important to maintain good credit so nothing throws a wrench into your final mortgage approval.”

To find out or track your score, you can obtain your file from a credit bureau (TransUnion or Equifax); some banks and Caisses Populaires allow you to consult your score free of charge. In any case, we recommend that you do a few checks and have any errors that might exist corrected before applying for a loan.

Low credit rating: what are the solutions?

If you’re confident in your ability to buy a property, but your credit record is creating obstacles, there are other options for you.

First, you could enlist a co-signer or guarantor with a higher credit rating than yours to compensate for a low score. Be aware, however, that this person will be responsible for repaying your loan if you are unable to do so.

You could also turn to alternative or private lenders. Bear in mind that additional costs are associated with these options, but they may represent a good short-term solution.

“A common strategy is to take out a loan with a private lender, then refinance with a bank the following year.”

Whatever your credit rating, calculating your borrowing capacity is essential before embarking on a buying process. Don’t hesitate to ask our team for advice on finding the dream home that aligns with your financial means.

With Vistoo, finding the perfect property is easier than ever. Whether you’re looking for a condo or a house, whatever the region, we offer an easy-to-use platform! Explore properties for sale that meet your search criteria.

About the author

Pascal

Bastien

Pascal has extensive experience in real estate, having contributed to market development and marketing for one of Quebec’s largest builders. With a master’s degree from HEC and in-depth industry knowledge, he is dedicated to helping buyers and renters make the best possible decisions.

The only thing that rivals his passion for real estate is his love for hockey. If you ever meet him on the ice, get ready to face a formidable player.