Great news: 30-year amortization for first-time buyers

The difficulty of accessing home ownership has been on everyone’s mind in recent years, particularly among young buyers. While a number of measures have recently been introduced, such as the FHSA, the federal government has just announced some big news that will delight many aspiring homeowners: the possibility of 30-year mortgage amortization.

Find out more about this new possibility, which offers a glimmer of hope for future buyers and a boost to the Canadian real estate market.

From 25 to 30 years: a difference that gives you breathing room

Following the implementation of the 2024 and 2025 reforms, the government focused on access to home ownership, which represents a challenge on several levels. As Finance Minister and Deputy Prime Minister Chrystia Freeland explained:

“Faced with a shortage of housing options and increasingly high rent and home prices, younger Canadians understandably feel like the deck is stacked against them.”

Among the measures now fully in effect, first-time buyers of any type of property (new or existing) can obtain a 30-year amortizing loan rather than the current 25-year limit on insured mortgages. The 25-year limit was introduced in 2012, and the 30-year limit will come into effect on August 1st.

This measure, which was expanded on December 15, 2024, likely allows a greater number of young buyers to access property, while also stimulating the market. Indeed, an extra 5 years can represent a difference of several hundred dollars per month! Here is a small comparison for a $500,000 property with a representative 2026 fixed rate:

|

$500,000 property at 5% interest |

25-year amortization |

30-year amortization |

|

Monthly payment |

$2,900 |

$2,650 |

|

Annual total |

$34,800 |

$31,800 |

This measure is aimed at first-time homebuyers and applies to new construction and new homes only. Other buyers will still benefit from a maximum 25-year amortization with an insured mortgage.

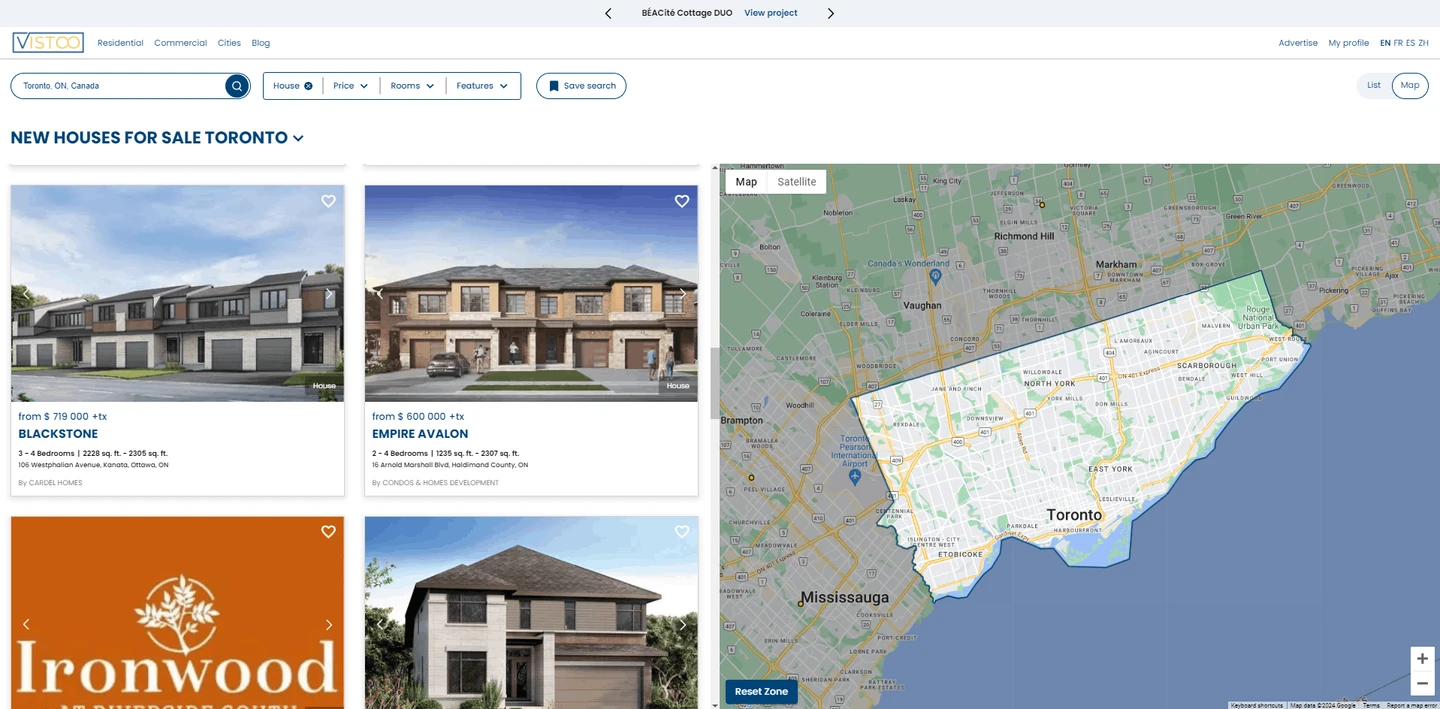

Have you always dreamed of buying a home? Explore our homes for sale and new constructions across Quebec, as well as in Ottawa and Toronto. Our team is here to help you in your search.

Why amortize over 30 years?

It’s true that amortizing over 30 years reduces monthly payments... but critics will be quick to point out that this means higher total costs. We can’t argue the contrary: paying 5% interest for 30 years is obviously more expensive than paying 5% interest for 25 years. On the other hand, this access measure remains highly advantageous for several reasons.

Greater access for the middle class

This is the first and most obvious advantage: a longer amortization period allows households on a slightly tighter budget to enter the market. Middle-class households, especially those who know that their income will increase over the years, are able to access home ownership more quickly.

Greater purchasing power

At a time when real estate prices have risen sharply, lower monthly payments will also enable buyers to get their hands on a property at a higher price than with a 25-year amortization. This makes it easier to find the ideal home or condo for sale.

Financial flexibility

This solution also offers households greater financial flexibility. Although they pay more interest over the long term with this type of loan, there’s nothing stopping them, after a few years, from:

- Reorganizing their loan

- Making principal payments

- Making a lump-sum payment

All in all, the 30-year amortization by no means represents a trap or a stranglehold, and it’s possible to adopt a variety of strategies depending on the evolution of your financial situation and the loan you’ve taken out.

Naturally, this may not be the most advantageous option for some buyers, who must meet the criteria of being a first-time buyer and acquiring a new property. For those concerned, however, this announcement represents a considerable advantage.

Increased HBP limit

The announcement of the 30-year amortization was accompanied by another measure designed to stimulate property purchases: an increase in the Home Buyers’ Plan (HBP) limit. This allows you to withdraw money from an RRSP to buy a home; until now, you could withdraw up to $35,000. Good news: this limit is rise now to $60,000!

And there’s more: the grace period before starting repayments, which was 2 years, will be temporarily extended to 5 years for first withdrawals made between January 1 and December 31, 2025.

With a longer amortization period and greater ease in obtaining a sufficient down payment, first-time buyers benefit from welcome assistance. Learn more about subsidies and incentives for first-time homebuyers in Quebec.

We know that buying your first home can be both exciting and a little stressful. At Vistoo, we have a team of proactive professionals ready to accompany you in your search with the country's largest real estate platform. Browse our new properties for sale according to your criteria and don't hesitate to contact us!

About the author

Yannick

Cloutier

Yannick has over 20 years of experience in real estate development, management, and sales. Passionate about real estate, he enjoys sharing his knowledge and finding innovative solutions to meet the needs of an ever-evolving market. As the owner of several businesses in the sector, he understands the challenges and opportunities of property management and maximizing property value.